With a charitable gift annuity (CGA), Duke University pays you a fixed income for life in exchange for a gift of cash or stock of $25,000 or more. The CGA agreement between you and the university can be established to pay one or two people, which make them especially attractive arrangements for individuals or couples who wish to supplement their income. After you pass away, the balance of your gift will be applied to the purpose you have chosen at Duke.

Duke offers three CGA options to provide income to you or your loved ones:

- Immediate payment CGA can begin payments to you right away.

- Deferred CGA provides strategic ways to increase income in the future.

- Flexible CGA offers more options to defer payments and increase your lifetime income.

Benefits of a CGA

- Receive a fixed income for you and/or your loved ones for life.

- You may receive an immediate income tax deduction and other tax-saving opportunities.

- If you are 70 ½ or older, you may be able to establish a gift annuity with assets from your IRA through a qualified charitable distribution (QCD).

- Establish your gift annuity with a gift of $25,000 or more.

- Enjoy charitable deductions and other tax-saving opportunities.

- Support the area of Duke most meaningful to you.

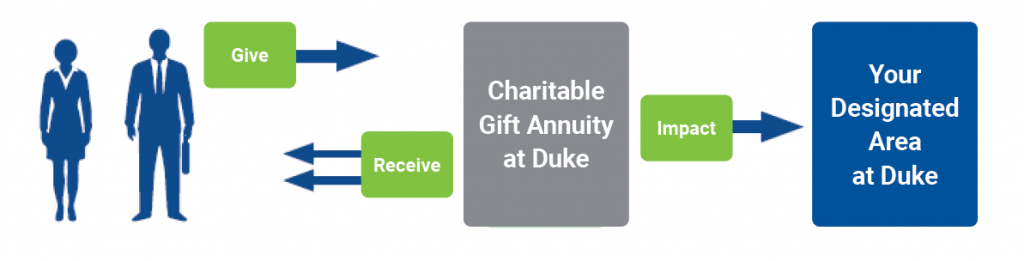

- You establish a gift annuity by transferring cash or stock to Duke.

- You and/or your loved ones receive fixed payments for life. Plus, you would receive an immediate income tax deduction (unless you establish the gift annuity with a QCD from your IRA).

- Once the individuals receiving payments pass away, the remaining gift annuity balance supports the areas and purposes at Duke that you care about most.

Fixed v. Variable Income

Duke also issues charitable remainder unitrusts with gifts of $100,000 or more. A charitable remainder unitrust (CRUT) will pay you and/or other designated recipients an income for life or for a specified number of years. The CRUT income is based on a percentage of the value of the trust assets as determined annually. Income payments will vary, depending on the performance of the trust’s investments each year. CRUTs offer many opportunities to address specific financial goals and situations. Duke’s Office of Gift Planning can help you and your financial advisors determine which gift vehicle is best for your particular situation.

Personalized Gift Annuity Illustrations

Contact Duke University’s Office of Gift Planning for a personalized illustration. We can provide you with estimated tax deductions and CGA payout rates based on your age, gift amount, and the anticipated payment start date.

Sample Gift Annuity Rates

*Rates effective as of January 1, 2023.

Gift Calculator

Use this gift calculator to receive an estimate of how a charitable gift annuity may provide benefits to you and/or your loved ones. The information you enter below will be kept completely confidential.

Unwrapping Gifts: Charitable Gift Annuities

Jeremy Arkin, senior assistant vice president of gift planning, describes how a charitable gift annuity at Duke can be part of a smart financial plan in this three-minute video.