A charitable gift annuity provides fixed income payments for life in exchange for a one-time gift of cash or stock. Donors typically receive an immediate income tax deduction in the year they make the gift. Gift annuities can have one or two life income beneficiaries, making them especially attractive for many individuals or couples seeking supplemental income. After the annuitants pass away, the remainder of the gift annuity will be applied to the area(s) or purpose(s) at Duke selected by the donor(s).

Potential Benefits For You

- Secure a source of fixed income for you and/or your loved ones. Payments can be scheduled as monthly, quarterly, semiannual, or annual direct deposits to your bank account.

- Receive an income tax deduction in the year the gift is made, and other potential tax-saving opportunities.

- Establish a gift annuity using cash, appreciated stock (owned for at least one year), or a transfer from a traditional IRA.

- If funding with cash, part of each payment to you will be tax-free for a number of years.

- If funding with appreciated stock, you may avoid tax on a portion of the appreciation.

- If you are 70 ½ or older, you may be able to establish a gift annuity with assets from your IRA using a qualified charitable distribution (QCD). A QCD transfer is not typically subject to income tax. Some limitations apply. For example, this type of gift does not generate a charitable income tax deduction, and the full amount of each annuity payment is taxed as ordinary income.

Potential Benefits For Duke University

- Contribute future support for Duke. Ensure that Duke continues to provide world-class education, research, and patient services for generations to come.

- Make an impact on mulitple areas. Direct your gift annuity remainder to support the areas and programs at Duke that are most important to you.

- Create a permanent endowment—or add to an existing endowment—in your name or in memory of a loved one, such as a financial aid scholarship.

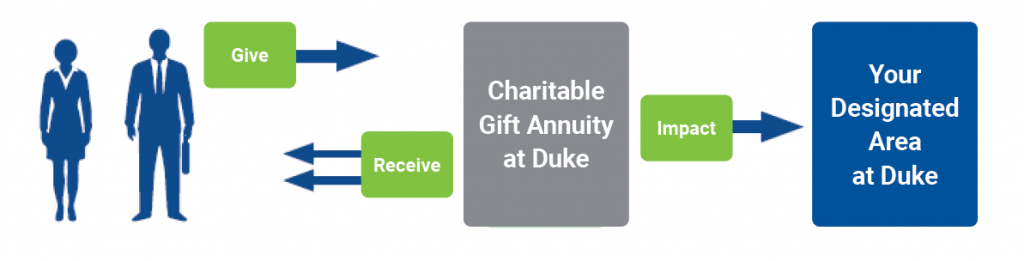

How it works

Give: You establish a gift annuity by transferring cash or stock to Duke.

Receive: You and/or your loved ones receive fixed payments for life. You receive an immediate income tax deduction (unless you establish the gift annuity using a QCD).

Impact: Once the individuals receiving annuity payments pass away, the gift’s remaining balance goes to support the areas and purposes at Duke you care about most.

How to get started

- Contact Duke’s Office of Gift Planning for your personalized gift annuity illustration. Learn about the gift annuity payout rates and estimated tax deductions available based on yourage, anticipated gift amount, and payment start dates.

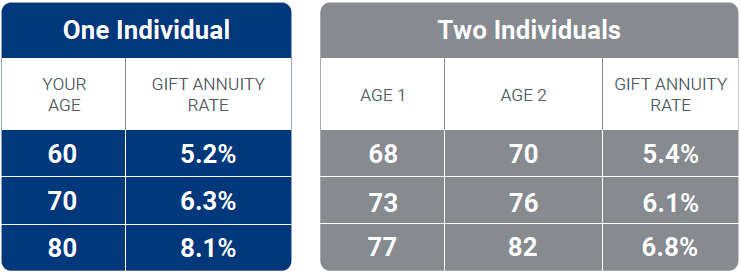

Sample payout rates* for gift annuities making payments to one or two individuals:

*Rates suggested by the American Council on Gift Annuities, effective as of January 1, 2024. - Discuss this giving option with your personal advisors to determine whether it’s the right fit for you.

- Establish your gift annuity at Duke with a gift of $25,000 or more of cash and/or appreciated securities.

- Receive an immediate tax deduction for part of the gift’s value (unless you establish the gift annuity using a QCD) and an income stream for life.

Other gift options

Consider these other options that may help you meet your personal and financial goals. Contact us for more information.

For increased income and immediate tax savings:

A deferred charitable gift annuity may be the right fit for a donor who does not currently need additional income, but who is seeking a charitable tax deduction now and a strategic way to increase income in the future. When you establish this type of gift annuity, you choose a date in the future on which to receive your first payment. This deferral results in a higher annuity rate and a higher income tax deduction, which is still recognized in the year of your gift. This option is often used in retirement planning.

For flexible start date and immediate tax savings:

A flexible charitable gift annuity is a type of deferred annuity that allows you to choose a range of future dates on which your annuity payments may begin. Beginning with the first date in your selected range, you decide whether to begin receiving payments, or defer them for another year. The longer you defer payments, the higher your payout rate will be. You will still receive a charitable income tax deduction in the year of your gift.

For variable income:

A charitable remainder unitrust (CRUT) is a trust that pays you and/or other beneficiaries an income for life or a designated period of time (up to 20 years) and ultimately benefits your favorite charities — like Duke! Unlike a charitable gift annuity, a CRUT provides variable income payments that increase or decrease based, in part, on the trust’s investment performance each year. Duke may serve as trustee of a CRUT with an initial gift of $100,000 or more. The donor(s) typically receive a charitable deduction for part of the gift’s value. As with a CGA, a CRUT may be funded with cash or stock. You may also make additional tax-deductible contributions to a CRUT over time, building the trust principal.

For a charitable gift annuity established with a transfer from an IRA:

Donors who are 70 ½ or older may establish a charitable gift annuity with a qualified charitable distribution (QCD) from a traditional IRA. Payments must begin within one year of the gift. Each taxpayer may only establish a QCD-funded gift annuity in a single calendar year during their lifetime. A charitable gift annuity established this way can only benefit the donor and/or their spouse (not friends or other loved ones), and the donor does not receive an income tax deduction for the gift, though there may be other tax benefits. For 2025, there is an aggregate limit of $54,000 per taxpayer. A married couple can contribute $54,000 from their respective IRAs for a total of $108,000. A QCD transfer is not typically subject to income tax; however, the full amount of each annuity payment will be taxed as ordinary income. For donors who are subject to mandatory annual withdrawals (currently, beginning at age 73), QCD amounts count toward their required minimum distribution in the year of the gift.

Unwrapping Gifts: Charitable Gift Annuities

Learn how a charitable gift annuity at Duke can be part of a smart financial plan in this three-minute video.