A charitable remainder unitrust (CRUT) is a special type of trust that pays you, and/or other designated beneficiaries, an income for life or for a specified number of years. When the trust term ends, the trust’s remaining balance is applied to the area(s) or purpose(s) at Duke of your choosing. You may establish a CRUT during your life, or with a gift through your estate plans to provide lifetime income for a loved one and an eventual gift to Duke.

Benefits

When you create a CRUT, you are eligible for a current income tax deduction for a portion of your gift. You may also be able to contribute appreciated assets to the CRUT, which can be sold by the trust without immediate recognition of capital gains taxes. Additional advantages may include:

- Establish a gift with as little as $100,000.

- Receive a lifetime income for you and/or a loved one.

- Enjoy charitable deductions and other tax-saving opportunities.

- Have assets managed by Duke, you, or your trusted advisor.

- Add to your CRUT at any time; some donors make additional tax-deductible contributions each year.

How it works

A CRUT pays a fixed percentage of its value each year to the income beneficiaries. This payout percentage must be at least 5%. The trust’s total assets are revalued annually, and income payments vary depending on the performance of the trust’s investments each year. If the trust principal grows, then the income payments grow along with it, which may provide a hedge against inflation. Conversely, if a CRUT’s annual net earnings do not exceed its payout rate in a given year, the following year’s payment will be less than the prior year.

While CRUTs are usually funded with gifts of cash or appreciated stock, it is also possible in some circumstances to fund a CRUT with assets such as real estate, artwork, and collectibles.

- You make a gift to establish your CRUT.

- You receive an immediate charitable deduction and a variable annual payout for life or for a specified number of years (up to 20 years).

- When the trust term ends, the trust’s remaining balance goes to support the area(s) at Duke most important to you.

Duke as Trustee

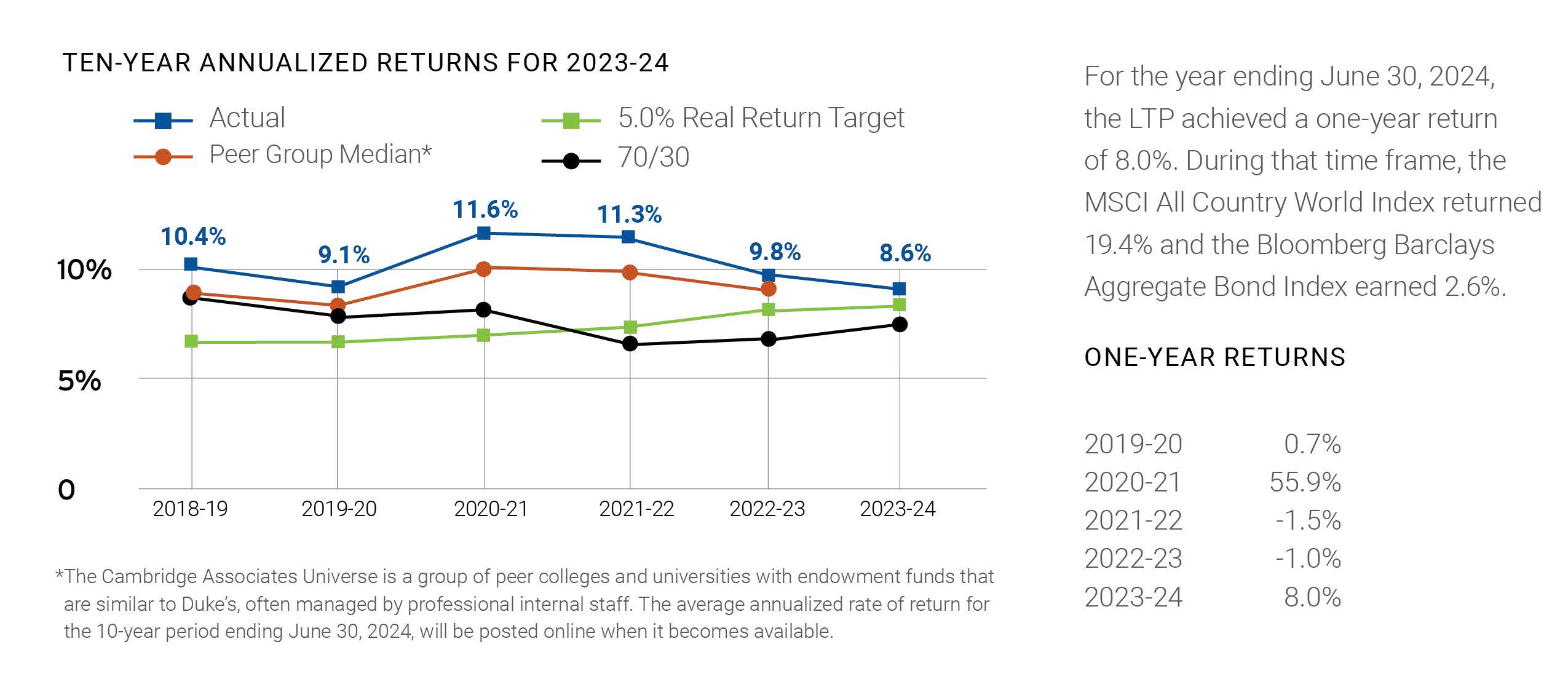

In most cases, Duke can serve as the trustee of a CRUT. The university does not charge a fee for this service but does pass along the costs of trust administration and tax preparation services (currently, 0.7 percent or less), which are provided by Bank of New York Mellon Corporation. With Duke serving as the trustee, your CRUT may be invested alongside the university’s endowment investments (the Long Term Pool, or LTP), or invested in other equity and fixed income funds.

Contact us for a personalized illustration of the tax deduction and payout rate combinations available to you, based on your age and anticipated gift amount. If you would like to explore a gift that provides a fixed- dollar payment that will not fluctuate with the financial markets, a charitable gift annuity may be an attractive alternative. This information is provided with the understanding that neither Duke University nor the authors are providing legal, accounting, or other professional advice or counsel. Please consult your personal counsel about the financial, tax, and legal implications of any gift.